Ban on credit cards in Australia

September saw the submission of the Interactive Gambling Amendment (Credit and Other Measures) Bill 2023. Financial instruments associated with credit, including digital currencies, are targeted for prohibition.

Several modifications have been proposed to change the measure since its introduction, which has sparked heated debate in parliament. Nonetheless, all failed in the end, and the measure was approved today (November 14) by both main parties in Australia.

Now that the lower house of parliament in Australia has finished debating the measure, it will go on to the Senate.

Clarifying the charge on the credit card

There are a plethora of other provisions in the bill that would be implemented, including the prohibition on loan goods.

Operators who choose not to enforce the prohibition would face severe fines. If licensees in Australia fail to comply with the new regulations, they might be fined up to AU$234,750 (£121,706/€139,707/US$149,722).

If the measure were to become law, it would grant further authority to the Australian Communications and Media Authority (ACMA). Among these, you can find the enforcement of both new and current punishment requirements, as well as the accountability for penalising individuals who violate the ban.

To give businesses, customers, and payment processors time to adjust to the new regulations, the government has set aside six months for the transition. Once the measure receives royal assent, this would be put into action.

Operators, harm reduction advocates, wagering and lottery suppliers, banking payment organisations, and a host of other stakeholders were consulted by the government in the process of draughting the amendment bill.

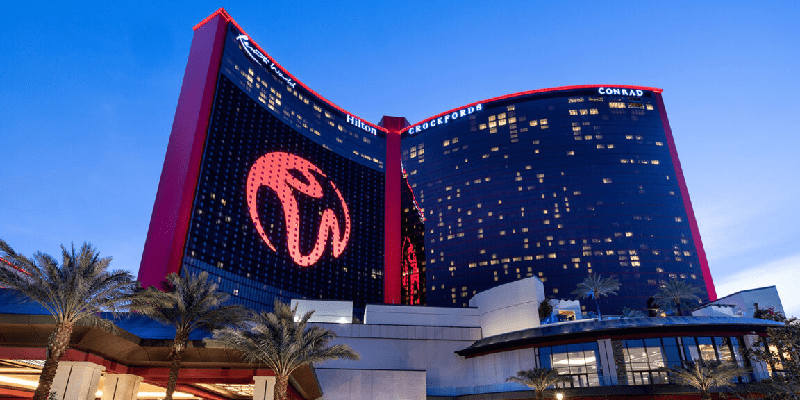

Conforming to Australian land-based regulations

Playing at land-based venues with credit cards is already illegal in Australia. This means that using a credit card to gamble would be illegal nationwide under the proposed legislation.

The discussion over an internet ban in Australia has simmered for years, and the day has finally arrived.

A number of proposals were issued in November 2021 by the parliamentary joint committee on financial services and corporations. If the new law passes, these will be put into practice.

Further back in time, in December 2019, the ABA (Australian Banking Association) held a consultation regarding the use of credit cards in gaming. How banks may aid in the prevention of gambling-related harm was also considered.

In the spring of 2020, following Britain's prohibition on credit card gambling, calls for action from the Australian government were increasingly louder. Bet365, Betfair, and Entain are among the members of Responsible Wagering Australia that have stated their support for a prohibition of this kind.

Some establishments have already banned customers from using their credit cards for gambling in preparation for a potential ban. One of these is Bank Australia, which banned gambling with its credit cards in October 2021.

More comprehensive measures to address harm caused by gaming

The proposed credit card ban is only one measure among many being considered to address the negative effects of internet gambling in Australia. The National Consumer Protection Framework is an umbrella term for a variety of initiatives.

One of these is BetStop, which debuted in August and lets users self-exclude from any licenced interactive betting service. There are operators available both online and over the phone. Since the program went live, over 10,000 individuals have enrolled.

Additionally, pre-verification is now required by law in Australia. As a result, before a consumer can open an account and place a wager, operators must confirm their identification.

Also, the government has instituted uniform training for industry employees across the country and introduced evidence-based slogans to replace "Gamble Responsibly.".