Q1 in Macau

Since fully reopening in January when all lingering pandemic restrictions were abandoned, Macau has recovered. This continued into the first quarter of 2023 and was cited by Melco as a key factor in the company's full-year growth.

All of Melco's gaming sectors and non-gaming operations showed progress in Q1, according to the company's analysis. A sustained uptick in international visitors to Macau during that time, it claims, was a major factor in this.

All properties increased their performance in response to the reopening, which led to higher revenue across all segments.

Melco aims to maintain this trend into Q2 and beyond, according to Chairman and CEO Lawrence Ho. In order to back up these ambitions, he mentioned a change in management, which included David Sisk resigning as COO for Macau, and a restructuring of its sales staff.

"This year has been full of surprises," Ho remarked. The marketing campaigns we launched and the new business we've acquired after the management changes in late February are the driving forces behind our improved performance in March and April.

"We are committed to staying ahead of the curve in every facet of our business and giving our customers the finest premium experience in Macau."

In Q1, casino income is close to $1 billion.

Analysing Melco's Q1 performance, we see that the casino was once again the company's primary revenue generator. Casino revenue hit $913.3m for the three months ending March 31, representing a year-on-year increase of 63.4%.

Additionally, income from rooms increased by 72.0% to $100.8m, and revenue from food and beverages increased by 79.6% to $66.1m. Entertainment, retail, and other revenue accounted for an additional $32.1m, or a 45.3% increase.

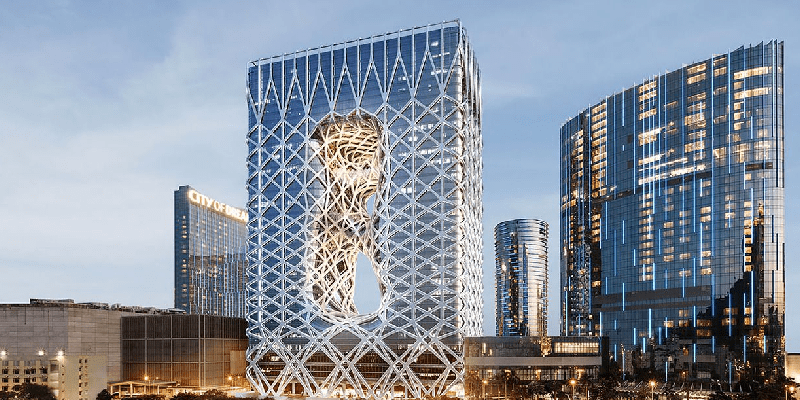

When broken down by individual properties, Macau's City of Dreams brought in $550.9 million, a 53.8% increase. This followed improved results in all gaming and non-gaming business categories.

Similar to the City of Dreams, Studio City saw a 133.1% increase in revenue to $331.4m in Macau. Meanwhile, Mocha and other operations saw a 6.3% increase to $31.9m in income, and Altira Macau saw a 43.7% increase to $34.2m.

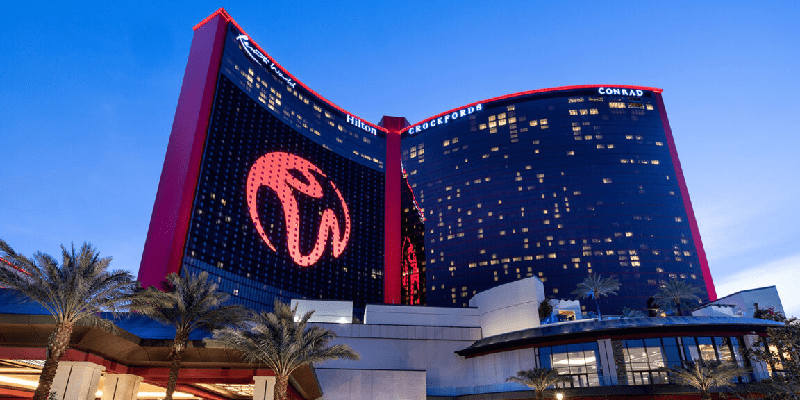

The City of Dreams Manila in the Philippines' capital city saw a 17.0% decline in income to $110.7 million, excluding Macau. This, according to Melco, is because the rolling chip section had a weak performance.

Moving on to Europe, Melco's three Cyprus satellite casinos run by City of Dreams Mediterranean saw an 88.5% increase in revenue to $52.4m.

"The City of Dreams Manila in the Philippines has maintained its strong performance in the mass segment, although it was affected by lucky breaks in the VIP segment," Ho added.

Despite ongoing hostilities in the region, City of Dreams Mediterranean and our satellite casinos in Cyprus demonstrated positive cash flow through the first quarter. We are cautiously hopeful that we can grow our business during the summer, when demand is often high.

Despite expenses being up, Melco is now profitable again.

Operating costs were $987.1m, a 37.8 percent increase from the previous year. Casino ($609.8m), general and administrative ($127.0m), and depreciation and amortisation ($131.8m) were among the important categories that reported higher costs.

Also increasing by 17.2% to $121.1m in Q1 were non-operating expenses. Nevertheless, Q1 pre-tax profit was $4.2m, a significant improvement from last year's $102.9m loss, thanks to the impact of revenue growth.

In addition to the $3.7 million in taxes it paid, Melco made $14.6 million from its non-controlling stakes. Consequently, the quarter's net profit was $15.2m, up from a deficit of $81.3m the previous year.

There was a 56.6% year-over-year growth to €298.8m in adjusted property EBITDA for the first quarter.

Ho expressed enthusiasm for Macau's gaming, entertainment, and leisure industries, saying, "We are extremely optimistic about the continued growth of gaming, entertainment and leisure in Macau and expect to maintain our leadership position with our exceptional portfolio of products.".